אחסן, מחליפים וממירים קריפטו לפיט בשניות — מאובטח, חלק ומסורתי לחוק.

הארנק שלך

לכל דבר קריפטו

אחסן, החלף והמר קריפטו למטבע פיאט בשניות — בטוח, חלק ותואם רגולציה.

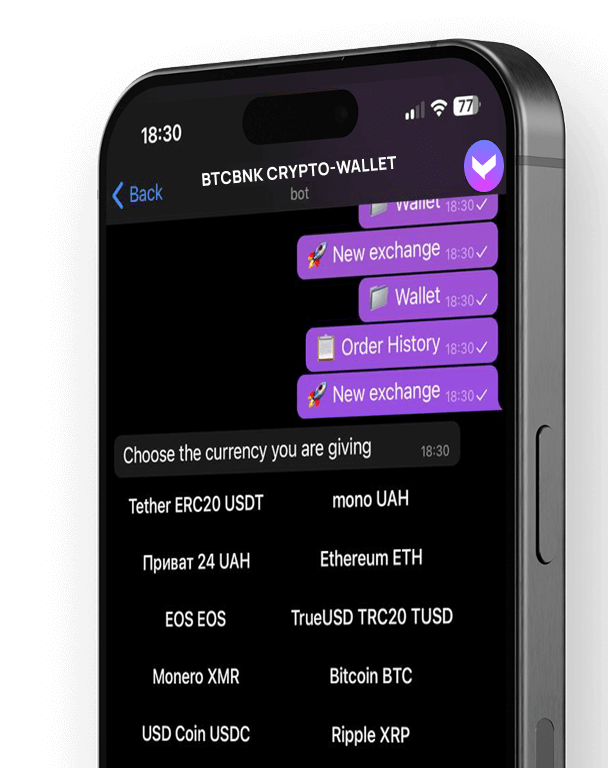

בוט טלגרם

בוט טלגרם

ועוד דבר אחד!

אנחנו משיקים בוט טלגרם - איפה שאתה יכול: צור ארנק - החלף - שלח - קנה באמצעות כרטיס או SEPA!

הנכסים שלך מאובטחים עם

עם שער התשלומים החלק והבטוח שלנו, אתה יכול לקנות ביטקוין, אתריום ונכסים דיגיטליים אחרים באמצעות כרטיס האשראי או הדביט שלך בכמה לחיצות בלבד.

שאלות נפוצות

סקירה כללית

חווה את החופש של ניהול הנכסים הדיגיטליים שלך עם ארנק הקריפטו הכל-באחד שלנו. אחסן, שלח וקבל מטבעות קריפטו בצורה חלקה עם מהירות ופשטות חסרי תחרות — הכל במקום אחד מאובטח.

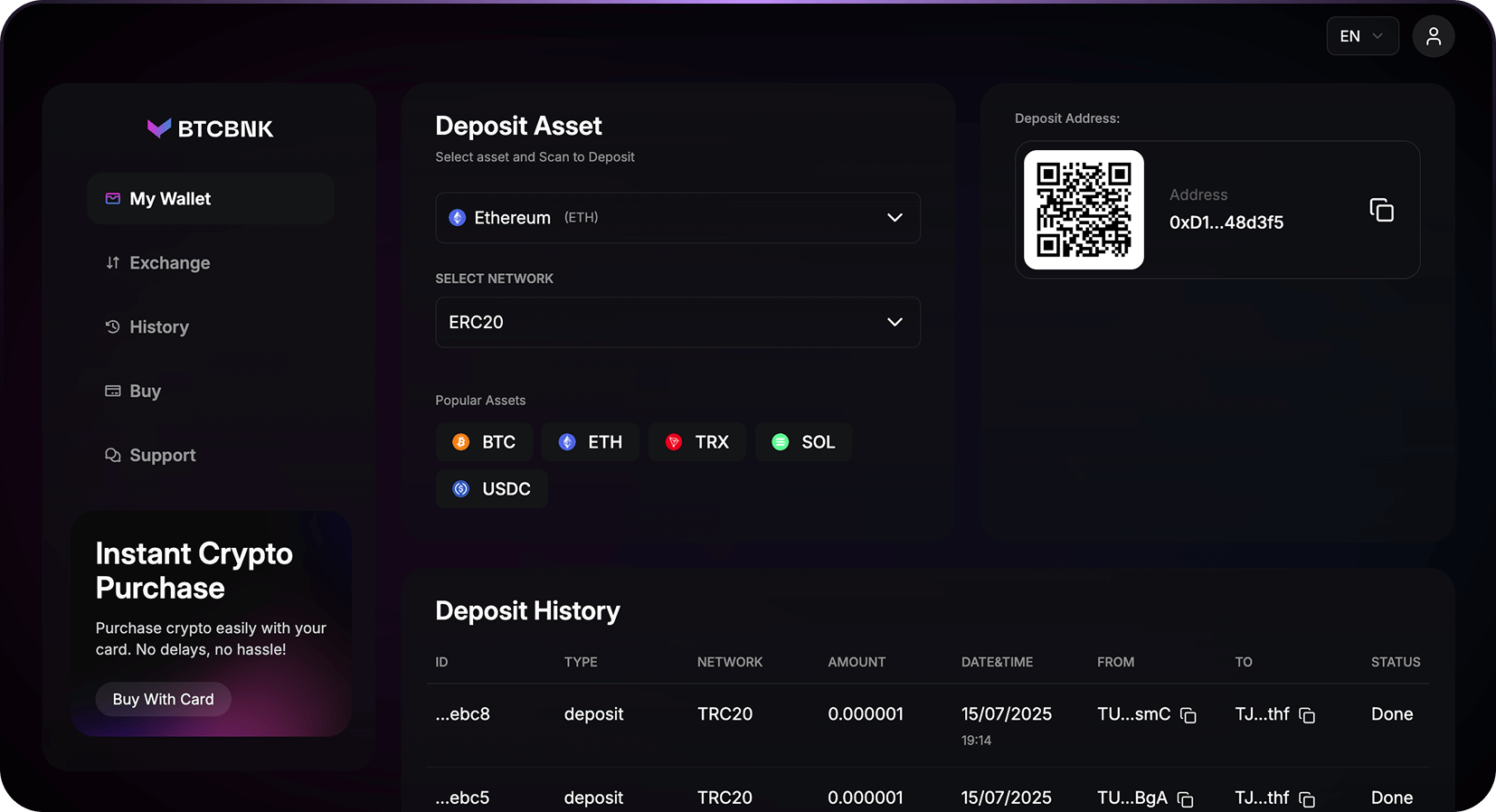

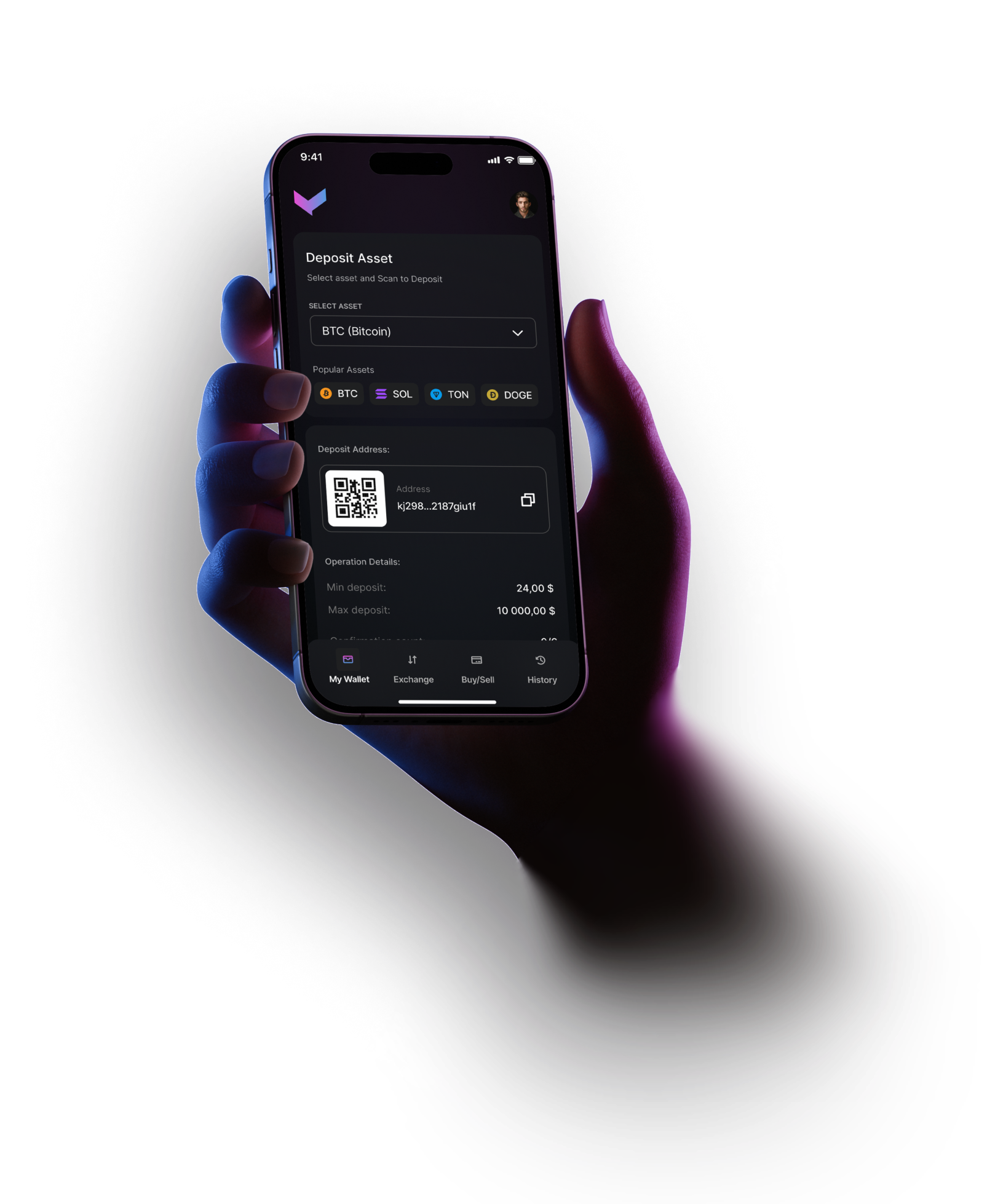

שירותי הפקדה

הפקד מטבע דיגיטלי

● צור מיד כתובות ארנק ייחודיות לכל מטבע קריפטו נתמך

● עקוב אחר הפקדות ממתינות בזמן אמת עם מונים לאישור

● זיכוי אוטומטי לאחר השלמת אישורי הרשת

● אין דרישות הפקדה מינימליות לרוב מטבעות הקריפטו

איך להפקיד

1. ניווט לסעיף הארנקים

2. בחר את מטבע הקריפטו שברצונך להפקיד

3. לחץ על "הפקד" כדי ליצור כתובת ארנק ייחודית

4. שלח כספים לכתובת זו מארנק החיצוני שלך

5. המתן לאישורי רשת (משתנה לפי מטבע הקריפטו)

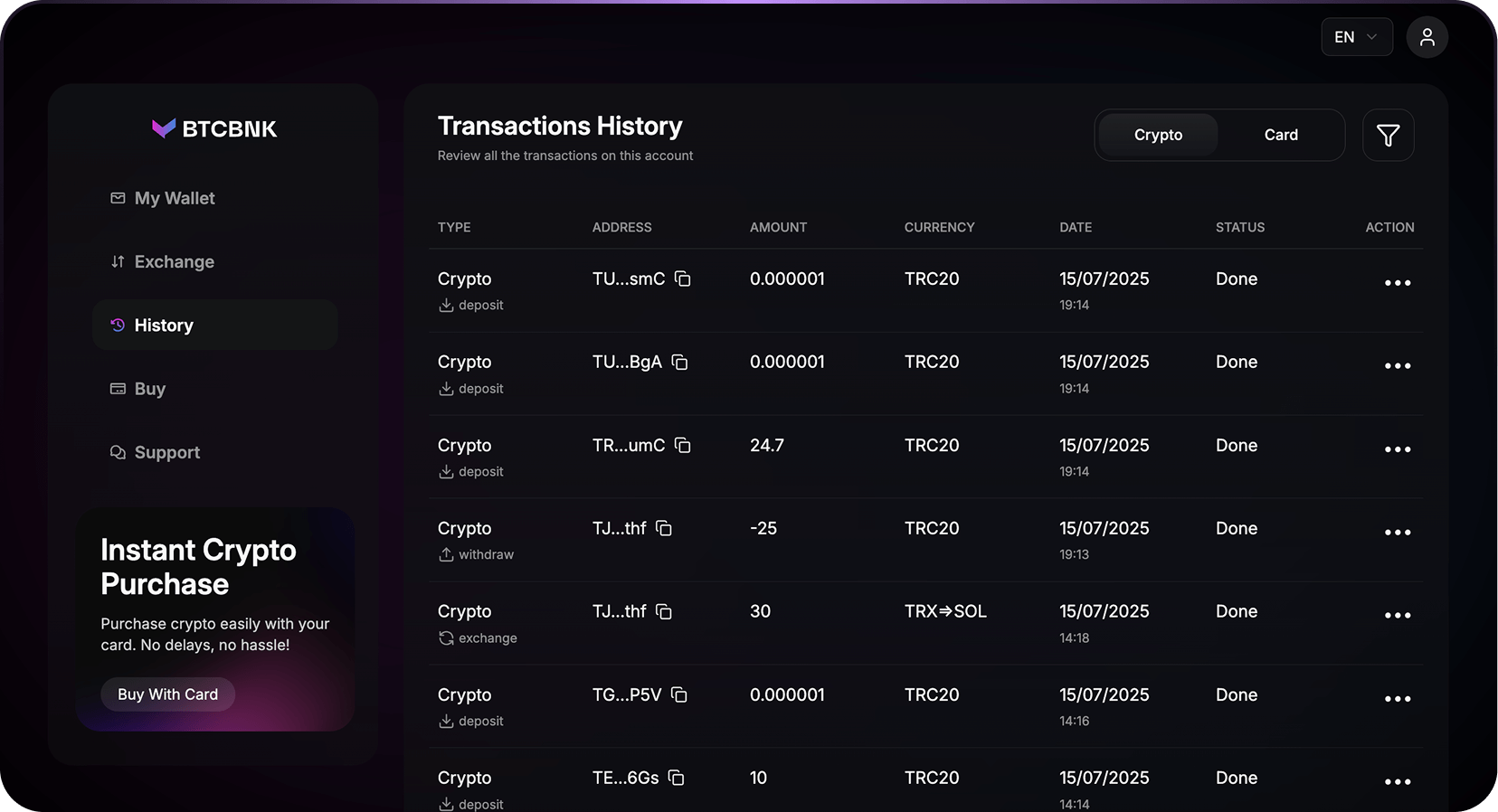

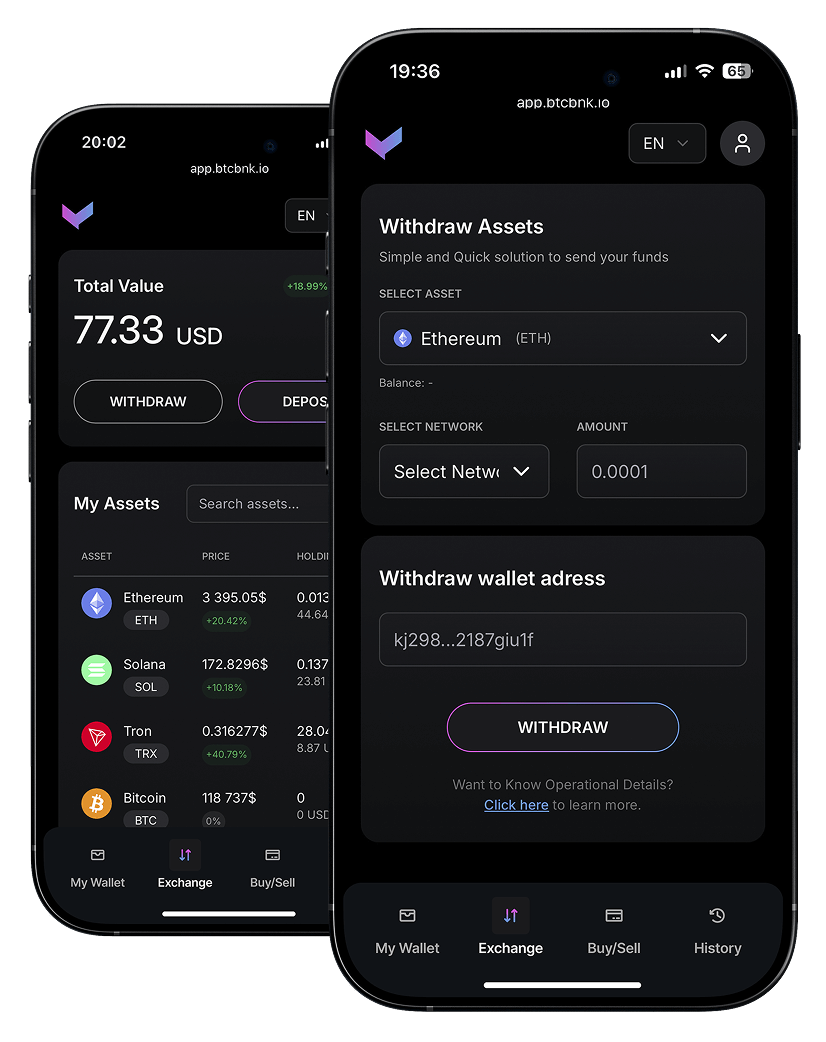

6. שירותי משיכה

משוך מטבע דיגיטלי

● משוך לכל ארנק חיצוני תואם

● עמלות רשת מותאמות אישית לאיזון מהירות ועלות

● תכונת ספר כתובות לשמירת יעדים תכופים

● אימות דו-שלבי נדרש לכל המשיכות

מידע חשוב על משיכה

● מגבלות משיכה משתנות בהתאם לרמת אימות החשבון

● זמני עיבוד תלויים בעומס הרשת

● עמלות רשת מחושבות דינמית בהתבסס על תנאים נוכחיים

● בדוק כפול את כל כתובות המשיכה – עסקאות לא יכולות להיות מבוטלות

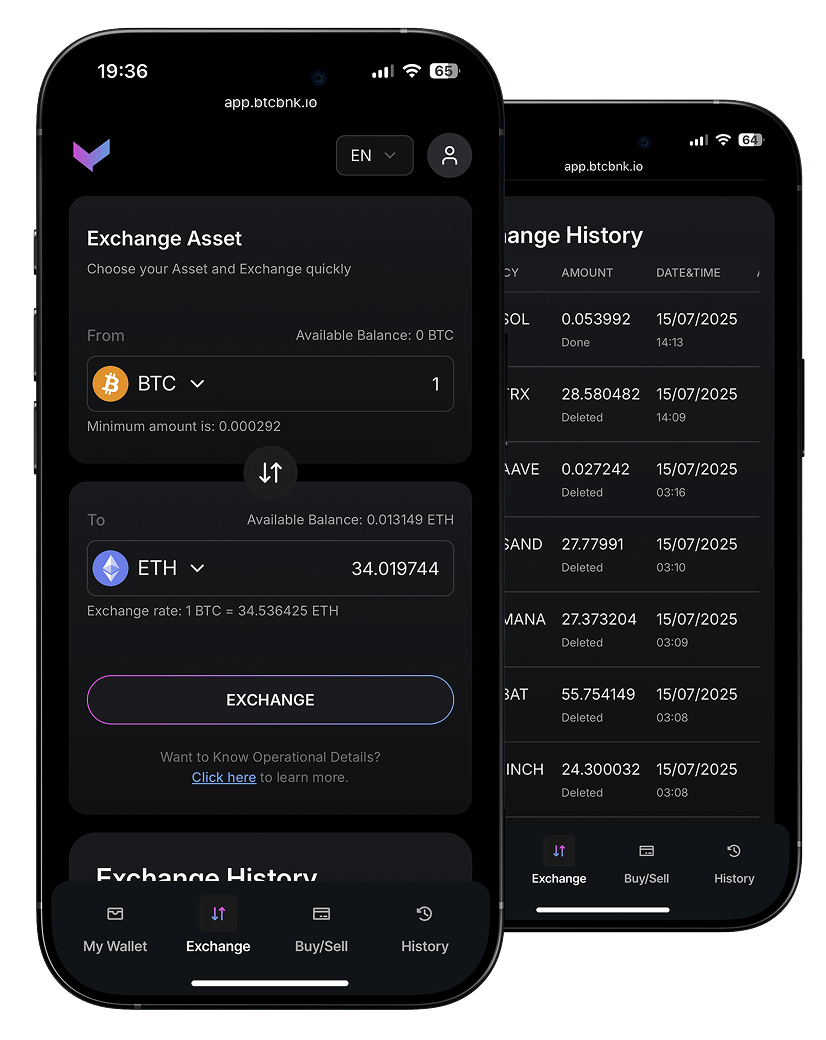

שירותי חליפין

החלף מטבעות דיגיטליים

● חליפין מיידי בין מטבעות קריפטו נתמכים

● שערי שוק תחרותיים מעודכנים בזמן אמת

● הצג היסטוריית מחירים מלאה ומגמות שוק

● הגדר הזמנות מגבלה לביצוע בנקודות המחיר הרצויות שלך

תכונות חליפין

● אין עמלות נסתרות – מבנה עמלות שקוף מוצג לפני אישור

● כלי תרשים מתקדמים לניתוח שוק

● היסטוריית חליפין זמינה להורדה למטרות חשבונאות

● זוגות מסחר מועדפים לגישה מהירה

קנייה עם כרטיס

קנה מטבע דיגיטלי

● קנה מטבע קריפטו ישירות באמצעות כרטיסי אשראי או דביט

● אספקה מיידית לארנק שלך

● תמיכה בספקי כרטיסים גדולים כולל ויזה, מאסטרקארד ועוד

● עיבוד תשלומים מאובטח באמצעות מערכות תואמות PCI-DSS

פרטי קניית כרטיס

● אימות נדרש לקניות כרטיס ראשונות

● מגבלות קנייה מבוססות על רמת אימות החשבון

● עמלות תחרותיות מוצגות בבירור לפני הקנייה

● זמין באזורים נתמכים (כפוף לתקנות מקומיות)

מכירה לבנק

מכור מטבע דיגיטלי

● המר מטבע קריפטו לפיאט ומשוך לחשבון הבנק שלך

● תמיכה ברשתות בנקאיות מרובות כולל SEPA, ACH והעברות בנקאיות

● משיכות קבועות מתוזמנות זמינות

● היסטוריית עסקאות מפורטת לדיווח מס

מידע על משיכה בנקאית

● זמני עיבוד: 1-5 ימי עסקים בהתאם לרשת הבנקאית

● אימות פרטי בנק נדרש למשיכה ראשונה

● מבנה עמלות משתנה לפי אזור ושיטת משיכה

● מגבלות מינימום ומקסימום חלות בהתבסס על רמת אימות

שאלות נפוצות

איפה כתובת הארנק שלי?

אתה יכול למצוא את כתובת הארנק שלך על ידי ניווט לארנקים בצד שמאל של דף המסחר, בחירת מטבע הקריפטו הרצוי, ולאחר מכן לחיצה על "העתק ארנק."

האם אני יכול לבטל עסקת מטבע דיגיטלי?

עסקאות לא יכולות להיות מבוטלות או שונות לאחר שהן יזומות. זה מה שמאפשר לסוחרים לקבל מטבע דיגיטלי ללא הסיכון של החזרות. זה גם אומר שמשתמשים חייבים להיות זהירים כשהם שולחים כספים, שכן עסקאות לא יכולות להיות מבוטלות, מלבד בקשה מהמקבל להחזר.

שלחתי כספים לכתובת הלא נכונה. איך אני מקבל אותם בחזרה?

בשל הטבע הבלתי הפיך של פרוטוקולי מטבע דיגיטלי, עסקאות לא יכולות להיות מבוטלות או הפוכות לאחר שנשלחו. בתרחיש זה, יהיה צורך ליצור קשר עם הצד המקבל ולחפש את שיתוף הפעולה שלהם בהחזרת הכספים. אם אתה לא יודע את בעל הכתובת, אין פעולות אפשריות שאתה יכול לנקוט כדי להחזיר את הכספים.

בשל כך, חשוב לנקוט זהירות בעת שליחה. תמיד מומלץ שתבדוק כפול שהכתובת שאתה שולח אליה תואמת בדיוק לכתובת המקבל לפני השליחה.

סקירה כללית

קבל גישה מיידית למטבעות קריפטו המובילים באמצעות כרטיס האשראי או העברת SWIFT שלך. ללא עיכובים, ללא סיבוכים — רק כמה לחיצות כדי להיות בעל הנכסים שמניעים את העתיד.

העברות SEPA

מהי העברת SEPA?

SEPA היא שיטת העברת בנק המשמשת לשליחת תשלומים במטבע יורו בתוך אזור התשלומים האירופי המאוחד. תשלומים אלה בדרך כלל לוקחים רק כמה ימי עסקים. העברות SEPA יכולות להיות רק במטבע יורו.

איך לעשות תשלום SEPA:

1. בדוק אם הבנק שלך מציע העברות SEPA

2. יש לך מסמך זיהוי מאומת, חשבון חשמל וסלפי שנוספו לחשבון BTCBNK שלך

3. ודא שהשם בחשבון הבנק שלך תואם לשם בחשבון BTCBNK שלך

4. אמת את חשבון הבנק שלך

5. שלח רק הפקדות במטבע יורו. העברות SEPA תומכות רק בהפקדות ב-EUR

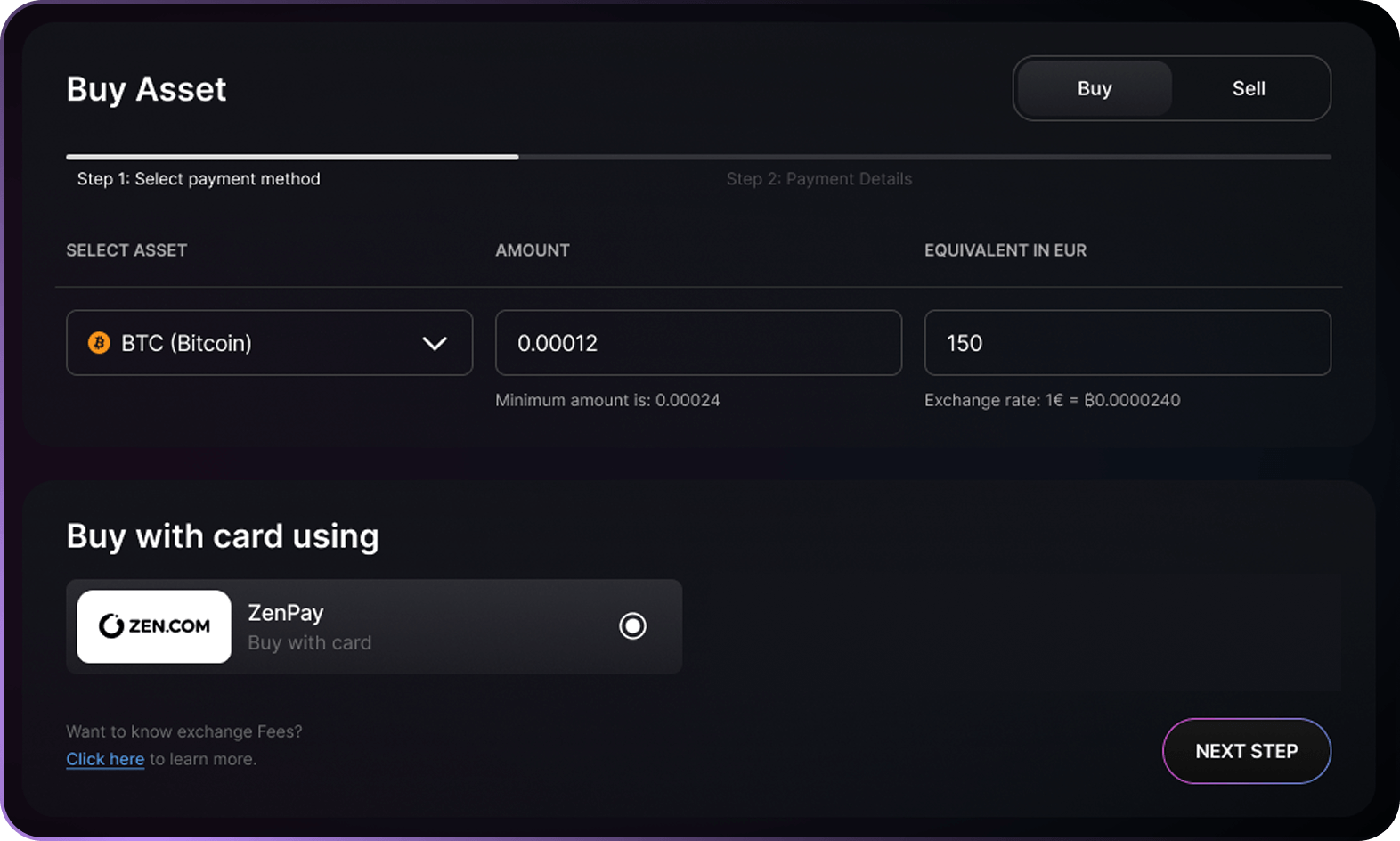

קניית מטבע קריפטו

איך לקנות מטבע קריפטו דרך העברת SEPA:

השלבים ליזום הפקדת SEPA הם כדלקמן:

1. בחר הפקדה בחלק העליון של הדף

2. בחר מטבע קריפטו שברצונך לקנות

3. השתמש במידע המוצג כדי ליזום העברת SEPA ביורו מחשבון הבנק שלך. חשוב לכלול את מספר ההתייחסות כדי להבטיח שההפקדה שלך מקושרת נכון לחשבון BTCBNK שלך

4. אנא שלח רק הפקדות במטבע יורו

הכספים שלך יזוכו לחשבונך תוך 1-5 ימי עסקים לאחר ביצוע התשלום שלך. אתה אחראי לכל עמלות המרה או החזרה שבוצעו על ידי הבנק שלך.

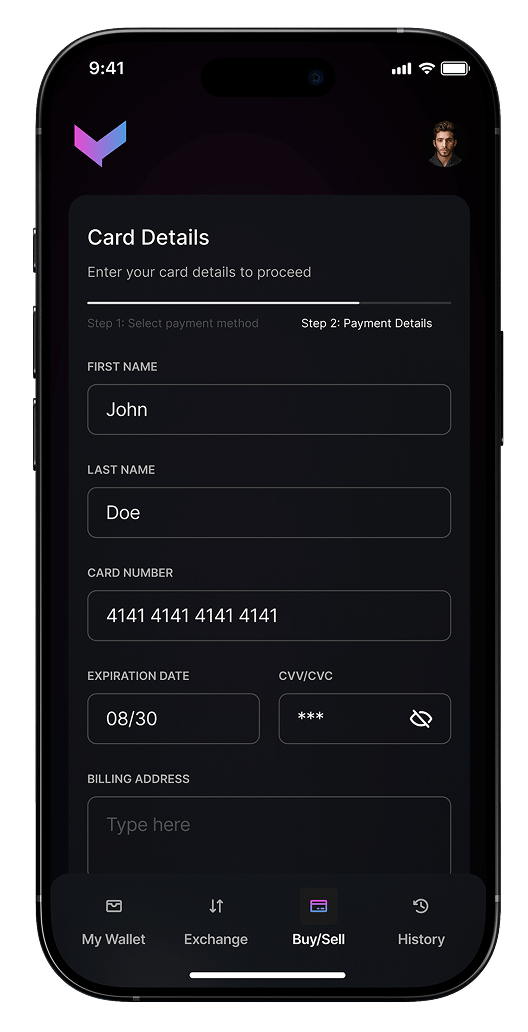

איך לקנות מטבע קריפטו דרך כרטיס אשראי/דביט:

אתה יכול לבצע רכישה של מטבע קריפטו עם כרטיס אשראי או דביט אם הכרטיס שלך תומך ב-'3D Secure'. אתה יכול לקנות באופן מיידי ללא המתנה להשלמת העברת בנק אם סכום ההזמנה שלך לא עולה על 500 יורו. כדי לקבוע אם הכרטיס שלך תומך ב-3D Secure, אתה יכול ליצור קשר ישירות עם ספק כרטיס האשראי/דביט שלך.

השלבים הבאים יובילו אותך דרך תהליך הרכישה 3DS:

עבור לדף ההפקדה

בחר מטבע קריפטו והסכום שברצונך לקנות

הכנס את פרטי הכרטיס שלך (הכתובת חייבת להתאים לכתובת החיוב עבור הכרטיס)

לחץ על 'השלם קנייה'

תועבר לאתר הבנק שלך, שם עליך לעקוב אחר ההוראות של הבנק שלך

משיכות

משוך לחשבון בנק:

כדי למשוך יורו מחשבון BTCBNK שלך, עקוב אחר השלבים הבאים:

1. בחר משוך בחלק העליון של הדף

2. בחר מטבע קריפטו והסכום שברצונך למכור

3. ספק את המידע המבוקש של חשבון הבנק שלך

4. אשר את המשיכה

משיכות בדרך כלל לוקחות 1-5 ימי עסקים להשלמה. כדי להימנע מאובדן עקב שערי המרה, אנא ודא שחשבון הבנק המקבל את המשיכה שלך הוא במטבע יורו.

מידע נוסף

● מבנה העמלות מוצג בשקיפות לפני אישור כל עסקה

● כל שיטות התשלום כפופות לבדיקות אבטחה ונהלי אימות

● מגבלות מקסימום ומינימום חלות בהתבסס על רמת האימות שלך

● שיטות תשלום זמינות עשויות להשתנות בהתבסס על האזור שלך עקב תקנות מקומיות

אימות זהות

סקירה כללית

הפלטפורמה שלנו מיישמת נהלי אימות זהות קפדניים כדי להבטיח את האבטחה של הנכסים שלך ולעמוד בדרישות הרגולטוריות הגלובליות. תהליך זה עוזר לנו לשמור על סביבת מסחר בטוחה תוך עמידה בהתחייבויות החוקיות שלנו.

למה אני מתבקש לאמת את הזהות שלי?

כדי לעמוד בחוקי מניעת הלבנת כספים ומימון טרור, DAXCHAIN נדרש לאסוף את המידע האישי שלך. כמו כן, אימות זהות נדרש למניעת הונאה ושמירה על הארנק האלקטרוני שלך בטוח ומאובטח. מסמכי זהות וכן מסמכי אימות אחרים חייבים להיות מועלים דרך חדר המסחר שלך.

כחלק מהמחויבות שלנו להישאר הפלטפורמה המהימנה ביותר למטבעות קריפטו, כל מסמכי הזהות חייבים להיות מאומתים דרך פלטפורמת המסחר של DAXCHAIN. אנחנו לא מקבלים עותקים של מסמכי זהות שנשלחו בדוא"ל למטרות אימות.

תהליך האימות

למטה תוכל למצוא את מדריך אימות הזהות שלנו.

העלאת מסמכי האימות שלך:

● התחבר לחשבונך

● העלה את כל המסמכים המבוקשים בלוח הימני בחדר המסחר שלך ועקוב אחר ההוראות

● ודא שכל המסמכים שלך תקפים

● צלם תמונה של המסמך המלא והימנע מחיתוך פינות

● ודא שמסמך הזהות נראה במלואו ובמיקוד טוב

● ודא שהאפליקציה או התוכנית שאתה משתמש לצילום התמונות לא מוסיפה לוגואים או סימני מים לתמונת מסמך הזהות

העלאת תמונת סלפי:

● ודא שהפנים שלך נראות בבירור

● פנה ישירות למצלמה וכלול מהכתפיים שלך עד החלק העליון של הראש שלך, ודא שיש מיקוד טוב על הפנים שלך והמסמך שאתה מחזיק

● השתמש בקיר רגיל כרקע אם אפשר

● אל תענוד משקפי שמש/כובעים או אביזרים מאסיביים אחרים

● אם אתה עונד משקפיים בתמונת הזהות שלך, ענד אותם בתמונת הסלפי שלך ולהפך

רמות אימות

הפלטפורמה שלנו מציעה רמות אימות מדורגות, כל אחת מספקת מגבלות עסקאות ותכונות שונות:

1. אימות בסיסי: אימות דוא"ל בלבד – פונקציונליות מוגבלת

2. רמה 1: אימות זהות – גישה לתכונות בסיסיות של הפלטפורמה

3. רמה 2: הוכחת כתובת – מגבלות הפקדה ומשיכה מוגברות

4. רמה 3: בדיקת נאותות משופרת – מגבלות הגבוהות ביותר וגישה מלאה לפלטפורמה

הגנה על פרטיות

אנחנו מבינים את הרגישות של המידע האישי שלך. כל מסמכי האימות הם:

● מוצפנים במהלך העברה ואחסון

● נגישים רק על ידי צוות ציות מורשה

● לעולם לא משותפים עם צדדים שלישיים אלא אם כן נדרש על פי חוק

● מעובדים בהתאם לתקנות הגנת המידע החלות

למידע נוסף על איך אנחנו מגנים על המידע שלך, אנא עיין במדיניות הפרטיות שלנו.

סקירה כללית

נוח לך בידיעה שהקריפטו שלך מוגן על ידי טכנולוגיות אבטחה מתקדמות. מהצפנה רב-שכבתית ועד ניטור הונאה בזמן אמת — הנכסים שלך נשארים בטוחים, תמיד.

אבטחת חשבון

מה אם שכחתי את הסיסמה שלי?

אם איבדת או שכחת את הסיסמה שלך, אתה יכול לאפס את הסיסמה על ידי ביקור ב-https://wallet.BTCBNK.io/reset-password. תצטרך גישה לחשבון הדוא"ל שלך ולאפליקציית האימות שלך כדי לחזור לחשבונך.

איך המידע של חשבון הבנק/כרטיס האשראי שלי מוגן?

BTCBNK מבצע שיפורים יומיומיים כדי להבטיח את בטיחות המידע האישי שלך. מספרי חשבונות ומספרי ניתוב מאוחסנים באמצעות הצפנה ברמה גבוהה בשרתים שלנו. בנוסף, כל התעבורה עוברת דרך SSL כדי למנוע גישה של צדדים שלישיים לחיבור שלך. גישת עובדים מוגבלת מאוד ואנחנו מבצעים בדיקות רקע רציניות על כל העובדים שלנו. אם אתה מעדיף לא לשתף את פרטי הכניסה שלך, אנא בחר "בנק אחר" בעת הוספת חשבון הבנק שלך, כדי להשתמש בשיטת אימות ההפקדה שלנו במקום. למידע על איך BTCBNK משתמש בחשבון הבנק המקושר שלך, אנא בקר בהסכם המשתמש של BTCBNK ובמדיניות הפרטיות של BTCBNK.

שיטות עבודה מומלצות לאבטחה

BTCBNK ממליץ לך בחום לקרוא את הדברים הבאים כדי להגן על החשבון שלך מגישה לא מורשית:

תמיכת לקוחות

צוות BTCBNK לעולם לא ישאל על הסיסמה שלך, קודי אימות דו-שלבי או פרטי כניסה אחרים. אנחנו לעולם לא נבקש ממך להתקין תוכנת כניסה מרחוק או תמיכה מרחוק במחשב שלך.

אם מישהו הטוען להיות קשור לתמיכת BTCBNK מבקש מידע זה, צור איתנו קשר מיד.

אתה יכול להשבית את החשבון שלך בכל עת באמצעות קישורי ההשבתה באימיילי איפוס סיסמה, אישור עסקה ואישור מכשיר.

סיסמה

אנחנו ממליצים בחום להשתמש בסיסמה מורכבת וייחודית שלא משותפת או דומה לאלו המשמשות באתרים אחרים. אנחנו גם מייעצים לשנות את הסיסמה שלך באופן תקופתי (בערך כל 3 חודשים) ולהשתמש בסיסמה חדשה לחלוטין בכל פעם. שימוש במנהל סיסמאות כמו 1Password או LastPass הופך את זה לקל לניהול.

כמו כן, לעולם אל תגלה את הסיסמה שלך לאף אחד. עובד BTCBNK לעולם לא ישאל על הסיסמה שלך.

אימות דו-שלבי

נצל את שירותי האימות הדו-שלבי (2FA) שאנחנו מציעים או אפליקציית TOTP כמו Google Authenticator. אפליקציות TOTP בטוחות הרבה יותר לקודי 2FA, מכיוון שהן קשורות למכשיר פיזי ספציפי, לא למספר טלפון, שיכול להיות מפורץ בהתקפת העברת טלפון.

אם ספק הדוא"ל שלך מציע פונקציונליות זו, שקול להוסיף 2FA לכתובת הדוא"ל שאתה משתמש להתחבר ל-BTCBNK. אל תשתמש ב-VOIP, Google Voice או ספקי טלפון אחרים ששולחים לך הודעות 2FA דרך דוא"ל לכתובת שאתה משתמש להתחבר ל-BTCBNK.

דוא"ל

אל תשתמש באותה סיסמה בחשבון הדוא"ל שלך כמו בחשבון BTCBNK שלך. אם ספק הדוא"ל שלך מציע זאת, הפעל אימות דו-שלבי (2FA) בחשבון הדוא"ל שלך כדי להוסיף שכבת אבטחה נוספת.

תכונות אבטחה נוספות

● ניטור IP ומכשיר: אנחנו עוקבים אחר ניסיונות כניסה ומתריעים על פעילות חשודה

● אישורי משיכה: אימות דוא"ל נדרש לכל המשיכות

● פסקי זמן של פגישה: התנתקות אוטומטית לאחר תקופות של חוסר פעילות

● אחסון קר: רוב הכספים מאוחסנים בסביבות מאובטחות לא מקוונות

● ביקורות אבטחה רגילות: מתבצעות על ידי חברות אבטחת סייבר של צד שלישי

תוכנית Bug Bounty: פרסים לחוקרי אבטחה שמזהים פגיעויות

סקירה כללית

ב-BTCBNK, אנחנו נותנים עדיפות להגנה על המידע האישי שלך וזכויות הפרטיות. אנחנו מחויבים לשקיפות בפרקטיקות איסוף המידע שלנו ולהבטיח עמידה בתקנות הפרטיות הגלובליות, כולל GDPR.

הבנת GDPR

מה זה GDPR?

תקנת הגנת המידע הכללית (GDPR) היא חוק מידע באיחוד האירופי ("EU") שמעדכן חוקי הגנת מידע קיימים כדי לחזק את ההגנה על מידע אישי עבור אנשים המתגוררים ב-EU. ה-GDPR שואף להגביר שקיפות לאיך מידע אישי משמש ולספק לתושבי EU ("נושאי מידע") יותר שליטה על המידע שלהם. חוק זה נכנס לתוקף ב-1 בפברואר 2025.

שימוש במידע

איך BTCBNK משתמש במידע שלי?

BTCBNK לוקח הגנה על מידע ופרטיות לקוחות ברצינות ומשפר ללא הרף את אמצעי האבטחה שלו. BTCBNK משתמש במידע של הלקוחות שלו רק לאימות זהות, הפעלת עסקאות ושיפור המוצר והשירותים שלנו.

כאשר אנחנו אוספים מידע זה בעיקר כי זה נדרש על פי חוק — כמו כאשר אנחנו חייבים לעמוד בחוקי מניעת הלבנת כספים — או כדי לאמת את הזהות שלך ולהגן עליך מפני פעילות הונאה פוטנציאלית. למידע נוסף, אנא עיין במדיניות הפרטיות המעודכנת שלנו.

איסוף מידע

איזה סוג מידע BTCBNK אוסף?

אנחנו עשויים לאסוף את הסוגים הבאים של מידע:

● מידע זיהוי אישי: שם, שם משפחה, תאריך לידה, לאום, מגדר, חתימה, חשבונות חשמל, תמונה, מספר טלפון, כתובת בית, דוא"ל.

● מידע זיהוי רשמי: מספר תעודת זהות, מספר דרכון, פרטי רישיון נהיגה, פרטי תעודת זהות לאומית, כרטיסי זיהוי צילומיים.

● מידע פיננסי: מידע חשבון בנק, היסטוריית עסקאות, נתוני מסחר ו/או זיהוי מס.

● מזהה מקוון: פרטי מיקום גיאוגרפי/מעקב, טביעת אצבע של דפדפן, מערכת הפעלה, שם דפדפן וגרסה ו/או כתובות IP אישיות.

● נתוני שימוש: תשובות סקר, מידע שסופק לצוות התמיכה שלנו, נתוני אימות, שאלות אבטחה, מזהה משתמש ומידע אחר שנאסף דרך עוגיות וטכנולוגיות דומות.

זכויות הפרטיות שלך

כמשתמש, יש לך מספר זכויות לגבי המידע האישי שלך:

● זכות גישה: בקש עותקים של המידע האישי שלך

● זכות תיקון: תקן מידע לא מדויק

● זכות מחיקה: בקש מחיקה של המידע שלך בנסיבות מסוימות

● זכות הגבלת עיבוד: הגבל איך אנחנו משתמשים במידע שלך

● זכות ניידות מידע: קבל והשתמש מחדש במידע שלך

● זכות התנגדות: התנגד לעיבוד המידע שלך

אמצעי הגנת מידע

אנחנו מיישמים אמצעים שונים להגנה על המידע שלך:

● הצפנת מידע במעבר ובמנוחה

● הערכות אבטחה רגילות

● הכשרת עובדים על הגנת מידע

● בקרות גישה קפדניות למידע אישי

● פרקטיקות מזעור מידע

● הערכות ספקים של צד שלישי

לפרטים מלאים על איך אנחנו מטפלים במידע שלך, אנא עיין במדיניות הפרטיות המקיפה שלנו.